Enablement Metrics That Matter

100+ Metrics that Matter

for Sales Enablement, Content Marketing and Value Selling

More Purchase Decision Friction

Forrester reveals that buyers are doing more diligence than ever before they make a purchase decision. In fact:- Buyers are having 60% more interactions with you, as a solution provider, from just three-years ago

- 80% of purchases now include a complex buying group with 60% of purchases having four or more people scrutinizing the decision (versus 47% prior)

- 75% of deals now have Executives as decision-makers (versus just 58% prior) and 51% have Finance as decision-makers (versus 35% prior).

Significantly More Buying Interactions and Buyers Involved Post-Pandemic

Post pandemic, Forrester research indicates that buying behaviours have changed:- From 17 to 27 - the dramatic increase in the number of buying interactions (both conversations and self-service) conducted by purchase decision makers during the pandemic.

- 63% - of purchases have more than four people involved — vs. just 47% in 2017 — and they can include different buyer roles — champions, influencers, decision makers, users, or ratifiers — from multiple departments.

A Matter of Trust - ed Advisor

Because today’s decision-makers are looking for more than just to be sold to. They’re looking for a partner and advocate they can trust. Consider these stats:- 56% of decision-makers will consider a brand if the sales professional understands their business needs

- 88% of decision-makers prefer working with sales professionals they perceive as trusted advisors

- 35% of decision-makers rank trust as the top contributor in closing a deal—above ROI or price

Digital and Remote – Here to Stay

Forrester indicates that post-crisis, the world of b2b sales and marketing will not return to the way it was before:- 53% of workers who are currently remote hope they will be able to continue to work from home (WFH) more often even after the crisis is over.

- 44% of US workers glad their business travel has been cut back

- 38% of respondents said the in-person sales meeting had decreased in value.

- 80% of B2B sales will now be done digitally and remotely

- 70% – At the start of the crisis. nearly 70% of B2B sellers stated they didn’t believe they could be as effective in a virtual sales meeting as they are in person, and as a result

- 40% of B2B reps plan to modify their tactics to adapt to remote selling activities

- 57% of B2B sales leaders plan to make deeper investments in tools with AI and automation to accomplish more with less and improve engagement effectiveness

The Growing Buying Committee

According to Gartner, the number of decision makers per deal has grown again, to include:- 14 for smaller purchases, <1M

- 19 for medium sized purchases, of between $1 and $5M

- 23 for enterprise-level decisions of greater than $5M

Buying Ain’t Easy

According to Gartner:- 77% of B2B buyers state that their last purchase was very complex or difficult

- 94% of those B2B buyers surveyed experienced a cancelled purchase cycle, ending in “no decision”

- 84% of B2B buyers report that when a buying cycle does culminate in a “Yes” decision, it is taking longer than expected, for many up to two times longer.

Sellers Report Internal Purchase Decision Challenges

Sellers are reporting a struggle with internal purchase decision challenges, with:- 78% indicating that their top internal decision-making challenge is dealing with multiple stakeholders with different agendas,

- 49% indicating that their buyers and customers are taking longer to make decisions.

No Decision

Many forecasted deals end up struggling to close, and indefinitely stalled. In fact, according to CSO Insights:- Less than half (47.3%) of forecasted business ends up being closed

- A third (32.0%) is lost to the competition

- Over 20% ends up being indefinitely stalled, lost to “no decision”

No Decision is More Costly Than you Might Think

No decisions are becoming more frequent, with 94% of buyers reporting a cancelled buying journey over the past few months, and 40% of all buyer journeys end in "No Decision". No Decisions can be costly, for both the buying organization that wastes decision-maker review time and abandons the decision, and the vendor that expends precious selling resources. For a planned buying effort–one that had been budgeted or was part of a strategic plan, no decisions tend to happen later in the buying process. The estimated costs:- $70,000 – Buying Organization Costs

- $100,000 – Cost to Vendors ($25K each)

- $35,000 – Buying Organization Costs

- $60,000 – Cost to Vendors ($20K each)

Buying is Definitely More Complex and Difficult

When a buyer wants to make a purchase, the process has become much more complex and difficult to navigate:- 38% of purchase processes end in "No Decision".

- There is an increased scrutiny on spending with 53% of buyers have reprioritized their spending across all categories and 38% have put in place a spending freeze.

- Procurement and Finance are more involved, with 54% of all purchases requiring prior central approval and 38% of all new purchases requiring an RFP.

The Modern Buyer Challenge

Buyers have substantially changed:- 67% of the buyer’s journey is done before speaking to a sales rep (SiriusDecisions / Forrester)

- 40% of buyers say they prefer salespeople who offer solutions that solve their specific challenges (DiscoverOrg)

- 77% of buyers expect sellers to help them learn something new and share customized data insights (Forrester)

- 86% of buyers take the time to listen if their salesperson can provide meaningful insights about their business (Forrester)

- 88% – The percent of buyers who agree that the salespeople they ultimately do business with are “trusted advisors.” At the same time, just 40% of decision makers describe the sales profession as “trustworthy.” So, while buyers may distrust the sales profession in the aggregate, they do trust the salespeople they eventually buy from (Linkedin)

DiscoverOrg – https://discoverorg.com/blog/b2b-buyers-preferred-sales-aproach/

Forrester analysis of Evolved Selling – https://www.mediafly.com/wp-content/uploads/2017/12/MediaflyEvolvedSellingWhitePaper.pdf

LinkedIn State of Sales Report 2020 – https://business.linkedin.com/sales-solutions/b2b-sales-strategy-guides/the-state-of-sales-2020-report

Revenue Enablement Opportunity - Elevating the Customer Engagement Experience

In this world where customers would prefer not to talk to sales reps at all, but find little to no value in the online digital-only experience, sales leaders have to find a completely new means to give back what neither sellers nor digital can provide on its own - a superior customer engagement experience.Did you know ...- 43% of B2B customers prefer to not interact with a sales rep at all

- 23% - purchase regret for those customers preferring a rep-free experience is 23% higher than for customers who interact with a sales rep

- 64% of surveyed customers cannot tell the difference between one B2B brand’s digital experience and another’s.

- 76% of customers report doing nothing different as a result of engaging suppliers’ through digital means (e.g., websites, online tools, digital content).

What a Buyer Wants. What a Buyer Needs

According to Forrester research of what buyers want from their sellers:- 74% of buyers value sellers who pivot meetings to discuss what the buyer wants to talk about, not just a blind pitch

- 77% treasure getting customized data and insights from sellers who can teach them something new

- 75% want sellers to show how their products and services drive business value outcomes.

The New Reality

The new reality from COVID 19 and the resultant lockdown and economic uncertainty poses a significant challenge for sales professionals. A LinkedIn survey of more than 500 sales professionals found that:- 51% of their customers were experiencing budget cuts

- 45% indicated that specific industries were at a standstill

- 42% said there was turnover or layoffs at their customers’ companies

- 44% of respondents anticipated a decrease in responsiveness to outreach

- 44% of sellers indicated that their customer’s sales cycles had increased

Buyer changes over past 12 to 18 months?

How have buyers changed over the past 12 to 18 months? The top three responses indicated in the State of Sales Enablement Report for 2020 were:- 53% – indicate that Buyers require more financial justification

- 50% – say that Buyers conduct more research prior to engaging with sales

- 46% – signify that Buyers have increased expectations for value-added insights

Today’s Buyer Prefers Digital?

According to Forrester research:- 62% of B2B buyers say they can now develop selection criteria for finalizing a vendor list based solely on digital content

- 70% of prospects say that buying from a website is the most convenient way to buy business products or services

- 67% of buyers prefer not to interact with a sales representative as their primary source of information.

Even for Big Purchases, are B2B Buyers Going Pure Digital?

Even for highly complex and expensive (six figures or more) B2B products and services, today's buyer are migrating more and more towards a direct digital preference:- 33% of buyers say they prefer to engage in a seller-less transaction

- 44% of millennials, even more say they prefer a pure digital engagement

- 80% of B2B sales interactions between suppliers and buyers Will occur in Digital channels by 2025

Tech Buying gets the Business

More technology buying decisions are influenced by the business than IT. A challenge for most - enabling sellers to have credible and inspiring business conversations and engagements.- 63% of those who influence tech purchases now work in business functions outside of the IT department

- Back in 2014, IT was the most influential voice in 75% of tech buying decisions. Today that figure stands at only 39%.

- Over 40% of buying journeys in the tech sector extend beyond one year

- Nearly one in five takes more than two years.

Are Sellers still Relevant?

Forrester research reports that seller engagement will increase by 10% even as more transactions close digitally. However, sellers are falling short:- 77% of B2B buyers want integrated customized data or insights from sellers and 77% also want sellers to “help me learn something new”

- 75% of B2B prospects want sellers to “show how their products and services impact my business”, providing relevant use-cases, business value communication and quantification and success story proof-points

- 2/3rds of B2B buyers want access to products, parts and inventory availability online

Sales Experience is the Key Factor to Customer Loyalty, But Sellers are Falling Behind

50% of customer loyalty is driven by the "sales experience" provided by the supplier and seller, much higher than the other factors of Brand (21%), Product / Service Delivery (16%) or Price (12%). The Top Five Seller Skills indicated to create a great "sales experience" are as follows, however, many buyers report a 40% average decline in sellers ability to meet expectations (change YoY from 2019 to 2020):- Demonstrates unique insights (-52%)

- Helps me come to a decision (-34%)

- Understands and addresses different stakeholder needs (-41%)

- Helps me build support across my organization (-49%)

- Makes it easy for me to make a purchase (-30%)

Buyers Value Good Information and Purchase Ease

Gartner research found that 89% of customers indicated they are receiving high-quality information during the purchase process and that customers who received valuable information from suppliers to help advance the journey were.- 2.8x more likely to experience a high degree of purchase ease.

- 3x more likely to buy a bigger deal with less regret.

Vendors Struggle to Get Buyer Time and Attention

According to Gartner,- Only 17% of the buyer’s journey is spent in meetings with potential suppliers.

- The rest of the time is spent meeting with the buying group (22%), on researching independently online (27%), researching independently offline (18%) and other (16%).

Enterprise Deals: More Friction & More Effort

The magic numbers for enterprise deals, over $100k:- 6 – There are (at least) 6 decision-makers who are signing off on the new purchase.

- 14 – There’s a bigger group of 14 stakeholders who are involved in the evaluation process.

- 19 – On average, it takes 19 meetings to complete the sales cycle.

The Value Gap

There is a distinct value gap between what buyers expect and what sellers deliver:- 21% of buyers said that their interactions with sellers are “low-value”

- 80% of sellers still predominantly pitch products and services

- Only 20% are focused on what buyers really care about: their challenges, potential improvements, and the business value outcome of proposed solutions.

Sales Operations: Red Hot Growth, But Some Smokey Challenges

Sales Operations is experiencing significant growth and demand over the past couple of years:- The number of Sales Operations pros increased by 38% between 2018 and 2020,

- Over the same timeframe, the number of Sales Operations pros grew 4.8X faster than the sales function overall.

- 76% - Managing my organization's sales / business development tools

- 72% - Suggesting growth strategies for the sales team

- 72% - Expand selling by building relationships with existing customers and upselling

- 72% - Monitoring sales team performance

- 69% - Forecasting business performance

- More than one-third (36%) of survey respondents say that they found it a challenge to balance strategic and operational work. More than a quarter (27%) say they spent too much time fighting fires.

- Almost 9 in 10 (89%) of Sales Operations professionals agree that planning more frequently in a world that is in constant flux would be beneficial to the business in general and the sales organization in particular.

- Even with this understanding, 35% of Sales Operations pros say they plan quarterly or even less frequently than that.

- Less than half (49%) of respondents say they feel “well-resourced” in their role. Similarly, only 52% say they feel “empowered” in their organization.

- Unfortunately, Only 34% of Sales Ops professionals anticipate a headcount increase in the coming fiscal year

- Almost three-fifths (58%) of survey respondents say they face some kind of crucial data issue.

Sales Enablement Slowdown?

Sales enablement investments were growing but have slowed. Is it because the bloom is off the rose and the investments have not delivered? Did you know…- 80% growth- Between 2016 and 2017, CSO Insights reports that the percentage of organizations with sales enablement jumped from 33% to 59%

- 1.5% – Since then however, the growth has slowed. Two years on, the percentage of organization who have implemented sales enablement grew to only 61% (an anemic 1.5% annualized growth).

- 3 out of 4 falling short – There is general disappointment with current sales enablement efforts. CSO Insights reports that the percentage of sales enablement organizations that met or exceeded stakeholder expectations dropped from 36% in 2018 to 28% in 2019. This means that almost 3 out of every 4 sales enablement groups are falling short.

Sales Enablement Shortfall?

How much is Sales Enablement being adopted and utilized to full effect? Did you know…- Only 5% of B2B companies have fully mature sales enablement practices (Forrester)

- Only 55% have rolled out SEA, the most mature of these tools (Forrester)

- Only 9% of B2B organizations say they are optimized around placing buyers at the center of their sales enablement strategies. (Forrester)

Can Your Sellers Find the Right Content?

Sellers continue to struggle to find and customize content for customer engagements:- 65% of sales reps can’t find the right content to send to prospects (Saleshub)

- 43% – of B2B marketing decision-makers report that their companies have lost sales as a consequence of not having necessary content at the right time for a specific customer and 77% of the rest have experienced costly delays (Forrester/Forbes)

- 55% – the average time a sales rep squanders searching for the content they need and customizing the content for particular presentations and prospects (SiriusDecisions)

- 440 hours wasted by sales each year trying to find the right content (Forrester)

- >50% – the time, marketing is slow in responding to sales team requests for content, so sales team members resort to improvising their own content (Demand Metric)

Turn on the PowerPoint and Turn Off Your Buyer

Traditional, big, linear presentation decks are not effective:- One in three – admit to falling asleep during a PowerPoint presentation (MarketingProfs)

- One in five – would rather go to the dentist than sit through another presentation (Zogby)

- 74% of buyers want sellers to pivot the presentation / meeting to discuss what the buyer wants to talk about (Forrester)

- Five hours – the time each week the average seller wastes customizing presentations for customer meetings (Forrester)

Are Your Spending Right on Your Content Marketing

Content marketing spend is often suboptimal:- 28% of marketing spend is currently spent on content (Content Marketing Institute)

- 65% of content provided for sales is wasted because sales reps can’t find the content or because the content is perceived as low value or is not relevant to their selling scenarios (SiriusDecisions)

- $2.3 million is wasted each year on underused or unused marketing content (Forrester)

- 2/3’s of organizations report that they lose deals because they don’t have the content they need. (Demand Metric)

Can you Ensure Content Compliance?

Content consistency and compliance can be a challenge, with:- 4 out of 10 organizations admit that content is fragmented: a lack of consistency in expressing branding and key messages (Demand Metric)

- 50% of the time – marketing is slow in responding to sales team requests for content, so sales team members resort to improvising their own content (Demand Metric)

- 1/4 of sales teams – say they always or often create content without waiting for marketing to do it, unknowingly contributing to content fragmentation in the process (Demand Metric)

Value Selling is a Requirement

In today’s more frugal, risk averse environment, value selling is not a nice to have, but a requirement:- 66% of buyers say making a clear ROI case highly influences their purchase decisions, however, only 16% of sellers are very effective at this. (The Rain Group)

- 95% of B2B buyers now require financial justification on any significant purchase, now set at $50,000 or more (IDC)

- 2/3rds of buyers don’t have the time, knowledge, or tools needed to make business value assessments and calculations. (IDC)

- 81% of buyers expect vendors to quantify the value of proposed solutions and provide a formal business case proposal. (IDC)

- Only one in five buyers will ask for a business case. (IDC)

Importance of Business Value Assessment Tools

“Which content do you prefer to receive from a vendor you are interested in purchasing a solution from?”.- #1 – Thought leadership content by Independent Third Party (43%)

- #2 – Value Assessment Tools (42%)

- #3 – Case Studies (40%)

- #4 – #8 – White papers, recorded demos, video, e-books and blogs

A Failure to Launch

New product launches need good sales enablement:- 18-24 months are spent getting a new major campaign / product “ready” for launch (SBI)

- 40% of new campaign / product launches fail (New Product Success)

- #1 – The biggest barrier to success for a new product / campaign launch is lack of preparation in the go-to-market and sales launch (HBR 2)

The Content Management Struggle

Content Management has improved for many, but for some, remains a challenge:- 68% of organizations have five or more repositories (Docurated)

- 60% of organizations report content growing at a rate of a least 100 percent per year (Docurated)

- Over 90% of the content is currently managed in emails, file shares and cloud storage (Docurated)

Are Your Sellers Falling Short?

Sellers fail to meet performance and buyer expectations:- 47% of sales reps did not meet their quota goals last year, the fifth straight year of decline, where the percentage of sales reps missing quota continues to grow (this while the economy grew over the same period). (CSO Insights – Buyer Preferences Survey)

- A whopping 69% of sales reps are considered middle performers, those that are underperforming, but could be improved (Salesforce)

- Most buyers (58%) saw little difference among sellers, and 10.4% found no difference at all. When solutions are commoditized, The differentiation rests on the buying experience. (CSO Insights – Buyer Preferences Survey)

Are your Sellers Pitching or Listening?

The rank of “active listening” among the attributes that buyers most value from salespeople. This trait didn’t even rank in the top five for sales managers in their hiring process for sales reps. (LinkedIn State of Sales Report 2020) Sellers are not performing adequate discovery:- 57% of buyers indicate that their sales reps could do a much better job of discovery (Primary Intelligence)

- 1 in 5 buyers Indicate their sales reps have “poor” understanding of their business needs (Primary Intelligence)

- 90% of buyers would meet with sellers earlier but are delaying these engagements because sellers don’t take the time to understand their business and add value to the assessment. (CSO Insights – Buyer Preferences Survey)

Sales Training Conundrum

Sales training is required, but not always effective:- $10,000 – The cost per sales rep to implement a new sales methodology and training (Forbes)

- 79%– In as little as 30 days, people forget 79% of what they’ve learned in training (Qstream)

- 64% – Post-training reinforcement improves adoption. Users are 64% more likely (82% vs. 50%) to adopt when they have access to lessons learned on-the-fly by the entire team, and continuously incorporate them into and improve their ever-evolving methodology. (Aberdeen)

All Onboard

Whether you are growing or just replacing turnover, getting sales onboarding right is essential:- 34% is the current annual Sales turnover rate (Bridge Group)

- 71% of companies take 6 months or longer to onboard new sales reps; and a third of all companies take 9 months or more (CSO Insights – Sales Enablement Optimization Study)

- The #1 sales enablement productivity goal is “Reducing new salesperson ramp-up time”, indicated by 45% of sales executive respondents (CSO Insights – Sales Enablement Optimization Study)

Making Expand Selling a Priority

Assuring renewals and up / cross selling to existing customers is often the best sales opportunity:- 62% – indicate their top priority is “Driving growth through existing customers” (Forrester)

- 60 to 70% – The probability of selling to a new prospect is only 5-20%, while the probability of selling to an existing customer is 60-70% (MarketingMetrics)

- 3 to 4 times less – Expansion revenue from existing customers is 3 to 4 times less expensive to acquire than revenue from new-logo customers (TSIA)

Can you Spot the Difference?

It’s getting harder to differentiate from the competition:- 31% of potential deals are lost to the competition (CSO Insights – Sales Enablement Optimization Study)

- 58% – Most buyers (57.7%) saw little difference among sellers, and 10.4% found no difference at all (CSO Insights – Buyer Preferences Survey)

- 41% of sales executives indicate that their top sales execution challenge is “difficulty differentiating from competition” (CSO Insights – Sales Performance Optimization Study)

The Importance of Indirect Sales and the Channel

Indirect sales and the channel are vital to revenue growth for many organizations:- 49% of revenue is from indirect channels, with the average company working with 176 partners (Forrester)

- 35% of channel partners are falling short of their revenue targets (CSO Insights)

- 9 to 10 – It can take 9 to 10 months to get a new partner productive (CSO Insights)

Personalizing the Buying Experience is a Requirement

Your customers want a personalized buying experience:- 80% of customers are more likely to purchase a product or service from a brand that provides personalized experiences.

The Sales Adoption Challenge

Sellers don’t always adopt sales tools as anticipated:- Only 49% had a Sales Enablement Content Management solution with adoption rates of 76% or better (CSO Insights 2016 Sales Enablement Optimization Study)

- 88% of sales professionals are unable to find or bring up critical sales material up on their smartphones, and 60% of sales organizations report a longer sales cycle due to a lack of proper tools. (CSO Insights)

- 3x – high performing sales teams use three times as much sales technology as under performers (Forrester)

The Importance of Intelligence, Analytics and AI

- 65% of sales rep time is spent on non-revenue generating tasks (Forrester)

- 71% of sales reps feel they’re spending too much time on their data entry responsibilities (Forrester)

- 76% of sales professionals say using sales analytics has significantly or somewhat improved their ability to provide customers with a consistent experience across every channel. Not only do analytics open the door to a more efficient, accurate, and personalized process, but it also gives sales teams deeper insights to optimize their selling process. (Salesforce)

- 89% of top-performers indicate that technology is leveraged to glean better insight into how content is performing (CMI)

- 72% of top-performing organizations go a step beyond, understanding the ROI of their content (CMI)

- 80% of marketers in companies with good sales and marketing alignment show sellers both how and when to use content, and insights on content usage, consumption and effectiveness are essential to do this properly (Content Marketing Institute and LinkedIn).

- 40% – the impact of AI technologies on labor productivity, enabling sellers and others to be make more efficient use of their time (Accenture)

Are You Enabling Everyone You Need To?

In Sales Enablement, it’s not just the rep that needs activation:- 9 – B2B buyers will have interactions with an average of nine different roles before signing on the dotted line.

- 50% – Fifty percent of roles interacting with the buyer before purchase are not titles traditionally supported by sales enablement functions.

- #1 – The most influential customer-facing persona on B2B buying decisions is not the sales rep; it is the vendor solutions specialist

- 50% – Half of all B2B buyers met with a customer service rep during their purchasing journey – second only to the vendor sales rep.

The Value of Enablement Across Roles?

Proper Sales Enablement beyond sales and across different vendor roles has significant value:- 12% – Reps in high-performing sales organizations spend 12% less time searching for and manipulating sales assets.

- 47% – Organizations driving significant upsell are 47% more likely to enable customer success roles with an ongoing engagement plan.

- 2x – Organizations with high customer retention are nearly twice as likely to map the post-sale customer journey.

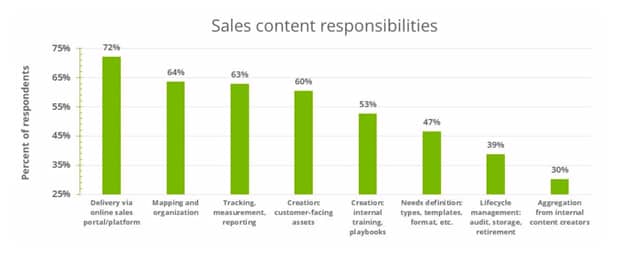

Sales Content Management Responsibilities

What sales content responsibilities are included in sales asset management (SAM)?- 72% – Delivery of sales content via online sales portal / platform

- 64% – Mapping and organizing the sales content

- 63% – Tracking, measurement and reporting on usage, consumption and value of the sales content

- 60% – Creation of customer-facing assets

- 53% – Creation of internal training and sales playbooks.

CRM and Sales Asset Management Integrations

The top three integration use cases between CRM and Sales Asset Management (SAM) are reported to be:- 60% – suggests content to reps for specific opportunities

- 55% – provides access to training directly within CRM

- 39% – sales assets available as a tab within the CRM system

Which Metrics to Track?

What high performing organizations track and report from their Sales Asset Management (SAM) system:- 69% – Content sent to buyers

- 59% – Number of content views

- 59% – Content tied to deal progression

- 59% – Won deals by content usage

- 59% – Content usage by rep

The Business Case for Sales Enablement?

With a return on investment (ROI) of 666%, modern sales enablement tools make great fiscal sense: The productivity benefits include:- 28% less time spent entering and coping with CRM data requirements

- 25% less time spent searching for needed content

- 23% reduction in time spent customizing content

- 23% less time working on low-value repetitive tasks (Forrester)

- 24% reduction in ramp time for new sales reps

- 19% reduction in the time it takes to engage a new lead

- 18% increase in the average number of transactions per seller (Forrester)

The Business Case for Evolved Selling

Implementing Evolved Selling can have a significant impact on sales revenue performance, with independent validation of the business value benefits from Forrester, with:- Up to a 82% lift in buyers likely to consider new opportunities, driving repeat business

- Up to a a 70% lift in buyers purchasing more than they scoped, driving an increase in cross sells

- Up to a 60% increase in company growth, driving company growth

- Up to a 43% increase in deal closure, pulling in next quarter or next fiscal year deals into current quarter